If you read our last article Life cycle costing and its four major benefits, you will understand that why choosing a supplier because they are the cheapest can often cost you more. In this article, we will take a deep dive into the various types of costs associated in life cycle costing. This will ensure that you take account of all costs when you are making a purchase decision.

Costs Over Time

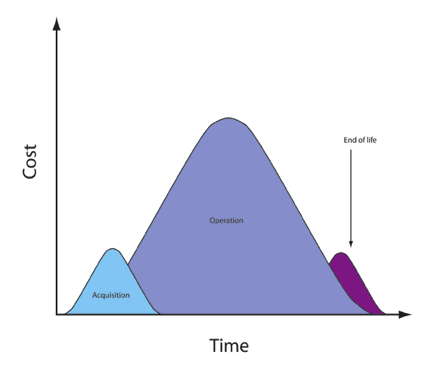

The diagram below gives an example of a spend profile showing how the costs of an asset or service vary with time.

The diagram below gives an example of a spend profile showing how the costs of an asset or service vary with time.

Acquisition costs are those incurred between the decision to proceed with the procurement and when the goods or services begin to be used. Operational costs are those incurred during the life of the asset or service e.g. maintenance/fuel costs etc. End of life costs are those associated with the disposal, termination or replacement of the asset or service. In the case of assets, disposal cost can be negative because the asset has a resale value. For other procurements the disposal, termination or replacement cost is extremely high and is something you need to take into account at the planning stage.

Life cycle costing is crucial because a purchasing decision normally commits you to over 95 per cent of the through-life costs. There is very little scope to change the cost of ownership after the item has been delivered. You can apply the principles of LCC to both complex and simple purchases, though a more developed approach is normally taken for the biggest purchases.

Who is involved?

In most companies, the management board is accountable for any decisions relating to procurement. The requestor should ensure that estimates are based on whole-life costs and is usually assisted by the purchasing manager or buyer, together with additional professional expertise as required.

One-off and recurring costs

LCC involves identifying a range of costs relating to the procurement. These can be either one-off or recurring costs. The distinction is important. One-off costs are sunk once the acquisition is made whereas recurring costs continue to be incurred throughout the life of the product or service. Furthermore, recurring costs can increase with time, for example through increased maintenance costs as equipment ages.

The types of costs incurred will vary according to the goods or services you are acquiring.

Examples of one-off costs include:

Examples of recurring costs include:

We hope this post has given you a better idea of the types of costs that are taken into account in life cycle costing. To learn more about this process, subscribe now and watch out for our next article on the topic.

Life cycle costing is crucial because a purchasing decision normally commits you to over 95 per cent of the through-life costs. There is very little scope to change the cost of ownership after the item has been delivered. You can apply the principles of LCC to both complex and simple purchases, though a more developed approach is normally taken for the biggest purchases.

Who is involved?

In most companies, the management board is accountable for any decisions relating to procurement. The requestor should ensure that estimates are based on whole-life costs and is usually assisted by the purchasing manager or buyer, together with additional professional expertise as required.

One-off and recurring costs

LCC involves identifying a range of costs relating to the procurement. These can be either one-off or recurring costs. The distinction is important. One-off costs are sunk once the acquisition is made whereas recurring costs continue to be incurred throughout the life of the product or service. Furthermore, recurring costs can increase with time, for example through increased maintenance costs as equipment ages.

The types of costs incurred will vary according to the goods or services you are acquiring.

Examples of one-off costs include:

- procurement,

- implementation and acceptance,

- initial training,

- documentation,

- facilities,

- transition from the supplier(s),

- changes to business processes,

- withdrawal from service and disposal.

Examples of recurring costs include:

- retraining,

- operating costs,

- service charges,

- contract and supplier management costs,

- changing volumes,

- cost of changes,

- downtime/non-availability,

- maintenance and repair,

- transportation and handling.

We hope this post has given you a better idea of the types of costs that are taken into account in life cycle costing. To learn more about this process, subscribe now and watch out for our next article on the topic.